Why does Pakistan tax so little?

Pakistan has been unable to expand taxation. Despite several donor-supported reform attempts, the tax-to-GDP ratio continues to hover around 10% of the GDP. The inability to expand tax revenue contributes to significant public service delivery gaps: over 20 million people live without clean water, almost one in every three people do not have a decent toilet, and about 40% children under the age…

Pakistan needs meaningful reform

Pakistan will survive this crisis. The government is slowing down the economy; it has almost entirely reversed the disastrous fuel subsides and started negotiations to resume the IMF programme. If it’s lucky, some friendly countries might even give us few billions in loan to shore up our dollar reserves. Crises averted – for the 22nd-odd…

Pakistan: New government, old problems

The curtains have drawn on Imran Khan’s premiership. His successor finds himself in a remarkably similar position as Khan did in 2018: struggling to pay for the large import bill, a budget deficit that likely needs to be financed by more debt, and a sliding rupee. That is the thing about Pakistan’s economy: nothing changes,…

Making policy decisions under uncertainty

Co-authored with Sir Paul Collier and Victoria Delbridge The COVID-19 pandemic has exposed policymakers to high levels of uncertainty: governments simply do not have enough information to know what to do. The result is changing policy decisions mid-course: Britain reversed its strategy of building herd immunity when a new estimate put the likely death toll from this…

Devolve more power to cities: they will need it more than ever

Co-authored with Astrid Haas. COVID-19 pandemic started in a city and spread through them. The core benefit of cities — as an enabler of proximity — is also their biggest liability. This is exacerbated when infrastructure and services are scarce. Across sub-Saharan Africa, only a quarter of people have access to necessary handwashing facilities, including…

The case for taxing landlords in Pakistan

BUY land for they aren’t making it anymore, Mark Twain once advised. Our politicians certainly seem to agree — some have over a dozen parcels of land to their name, according to recent asset declarations published by the Election Commission. None of this is a surprise. Pakistan’s rich (like the rest of us) like to…

How Pakistan’s sugar industry extracts rent

Published in The Express Tribune, May 8th, 2020. Co-authored with Dr. Adeel Malik. While an inquiry on the sugar sector has been made public for the first time, the crisis that necessitated this inquiry is a recurring feature of Pakistan’s sugar industry. Rattled by a controversy every 18 months, why is the sugar industry so…

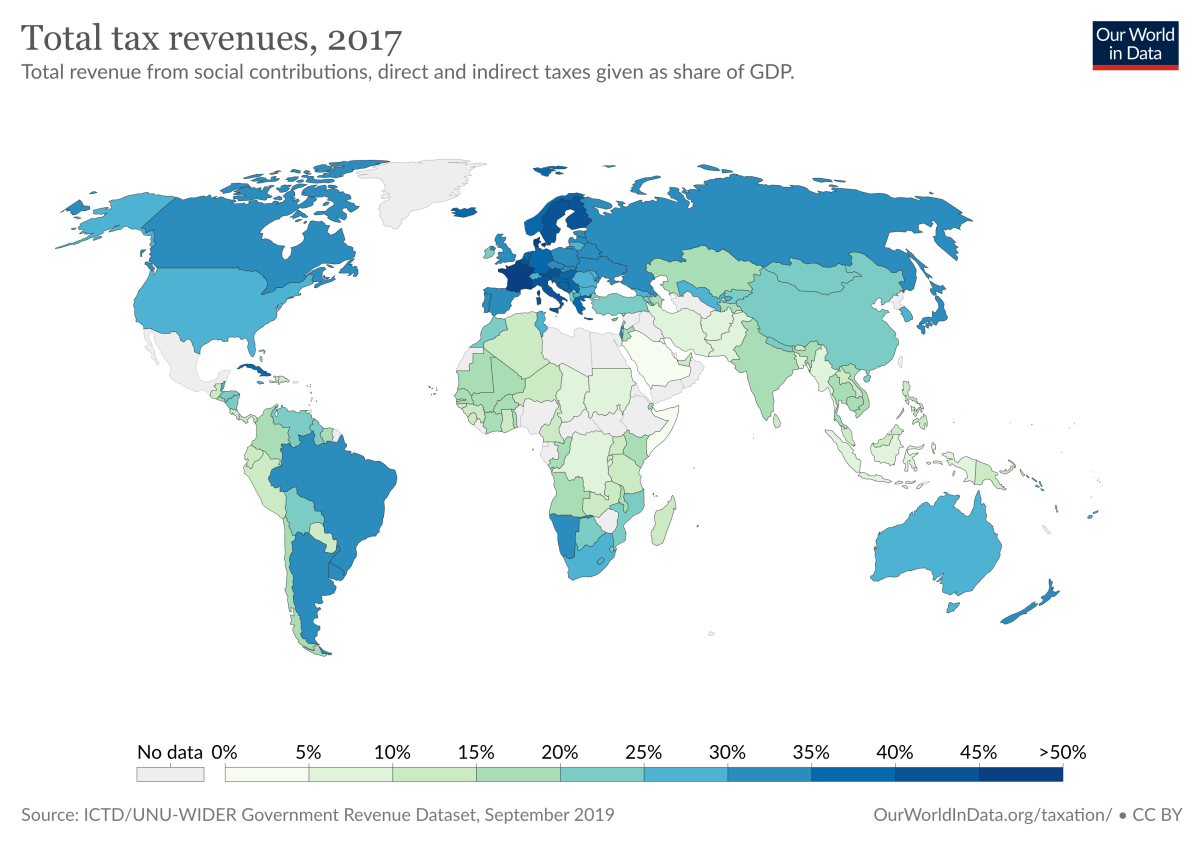

What prevents developing countries from taxing more?

Published: International Growth Centre, 12th Aug 2020. Virtually every country in the world taxes their populations. But, some do so more successfully than others. Most developing countries raise tax revenue equivalent to between 10% to 20% of their GDPs, some even less. Rich countries raise much more, on average 34%. If Pakistan distributed all its annual tax…

Pakistan’s urban transition

Our policymakers have failed to understand the importance of city governance.

What Pakistan needs to do to break the vicious cycle of IMF bailouts

Should we ignore much-needed underlying reforms, we are destined to be stuck in this vicious cycle.

Review of Punjab Local Government Bill 2019

The Punjab Local Government Bill 2019 aims to establish 9 metropolitan corporations for almost all major cities.

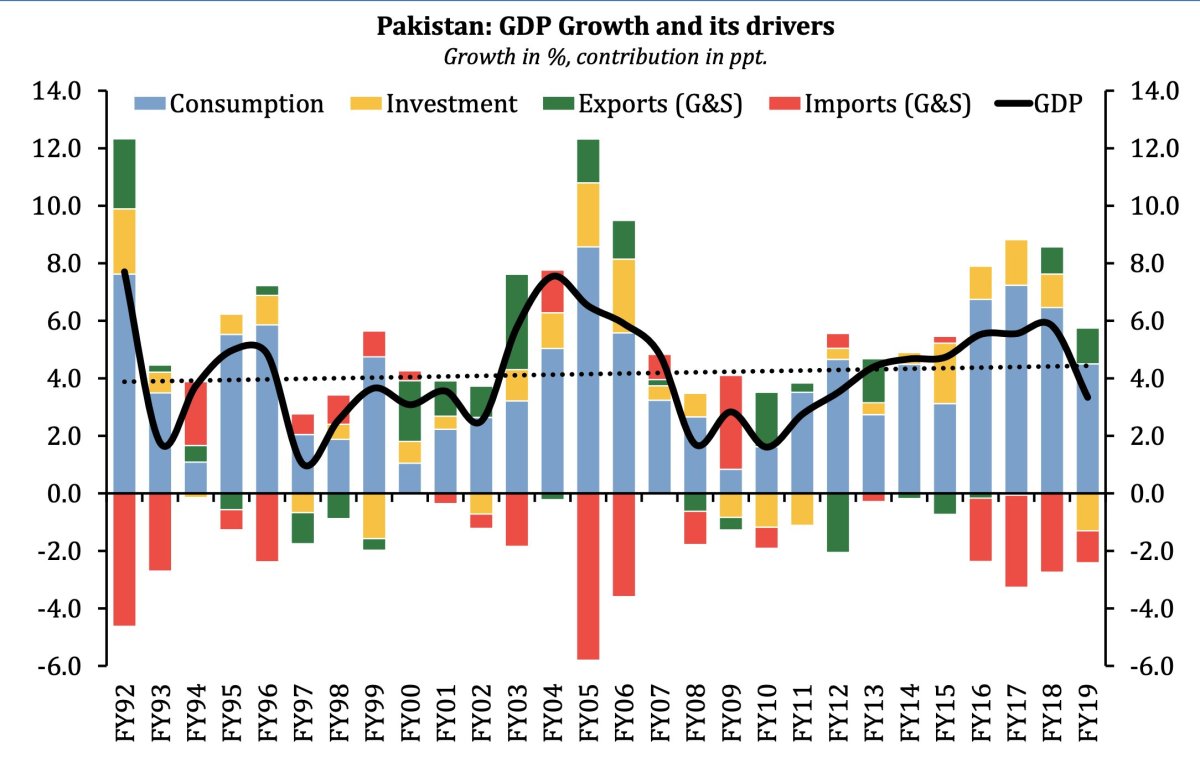

Pakistan’s Growth Story, Simplified

The story is now as Pakistani as it gets. We go to the IMF, get a few billion dollars, we use it to finance an import-led growth bubble which increases domestic consumption. It’s all good so far. We say goodbye to the IMF. Consumption allows us to proclaim that we’re growing. The GDP is growing,…

Reforming Pakistan’s tax system: Some thoughts

Increasing taxation is possibly the most fundamental challenge Pakistan faces today, not only to adequately finance public investment and services, but also to establish a fairer society.

Why Pakistan will go to the IMF again, and again and again

To fix the economy, focus on the political discourse

Thoughts on Joe Studwell’s ‘How Asia Works’

I just completed Joe Studwell’s new book “How Asia Works: Success and Failure in the World’s Most Dynamic Region.” Here are some thoughts I tweeted about after reading it. 1) Size of farms matters! Studwell argues that having a small (3ish acre) family-owned farms boosts agriculture productivity (read: land reforms!). There are various loopholes countries (like…

Imran Khan envisions a Pakistani welfare state. Is it possible?

This is an archived version of an article written for Dawn.com, published on Aug, 28th 2018. If you want to share it, please do so the version on Dawn.com. Pakistan has a new leader at the helm who, if his first address to the nation is to be considered at face value, is set to make a radical…

The case for a culture of learning

We need to improve the quality of schools, build infrastructure, and hire more teachers. We need all of this but, at the end of the day, we also need something broader.

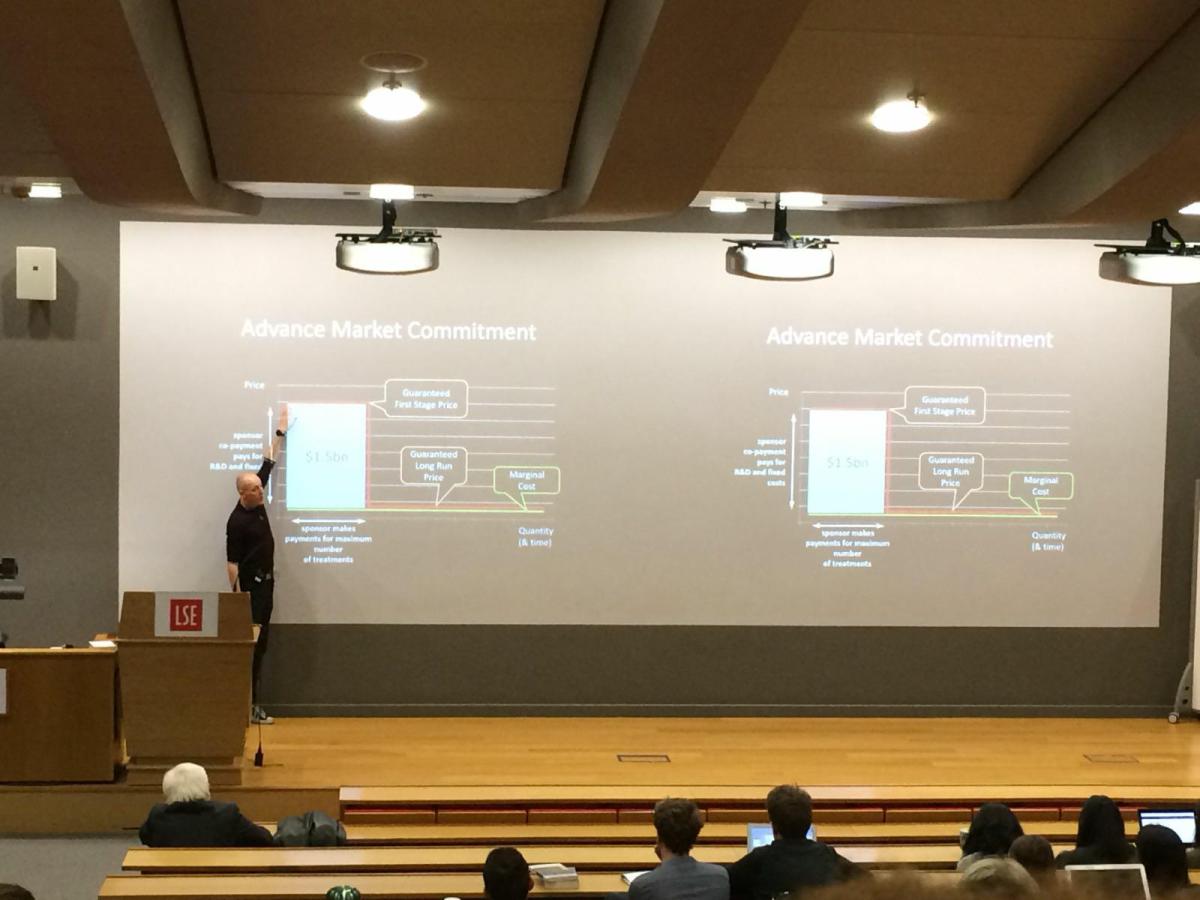

The Potential of Advanced Market Commitments

Markets are good for a lot of things. They have an irrefutable ability to cater to our demands, how seemingly ridiculous our demands might be. Think about silly putty. If enough people want it, they will get it. But there is a catch. You must be able to afford it. You can desire as much…

Pakistan is building schools to provide jobs, rather than education

The article was published by The Guardian. With more than 20 million children out of school, Pakistan has, at last, begun talking about its education crises. Our media and civil society routinely grill politicians on a lack of funding for public schools. Opinion sections of national newspapers usually publish a few articles a week on how…